About two years ago, I wrote an article1 that made me feel vulnerable from a reputational standpoint. The topic was about fraudulent candidates, and I discussed how I had experienced and been scammed by candidates posing as anti-money laundering or compliance experts. I felt safe enough to share those embarrassing stories because, first, it was important for me to show the extent to which people were willing to take advantage of the 100% remote work that took place during the pandemic. Second, I know how many hiring managers experienced negative effects, including frustration and wasted time, dealing with contractors and full-time employees who ended up not having the skills they purported to have. In some cases, the person who showed up on their first day was not the person who was interviewed. It got bad, to say the least. I needed to tell the story because the fraudulent candidate phenomenon had reached comical levels. (Please go back to “The Fraudulent Candidate Phenomenon” article.2 I believe it would be a good preface to this article).

In what literally felt like minutes after ACAMS Today published my fraudulent candidate article, my wife grabbed my attention and asked me if I had heard about the public stories of scams job seekers were experiencing. I became a living “shaking-my-head” emoji because I realized I missed the other side of this fraud phenomenon. It is time to share the craziness from a different angle.

As a financial crimes compliance recruiter, I think fraud and scams only happen in my self-involved world: at banks, fintechs, crypto companies and e-commerce sites. However, I know that fraud is an inherent possibility in any situation with a buyer and a seller. I never thought of the recruiting space and the hiring process as situations where people could gain anything (other than a job). But it is an obviously ripe target for fraudsters. Moreover, it could potentially be a whale of a target because, in the U.S., companies hire hundreds of thousands of people across all industries monthly. Then, you add to the mix the convenience of people job seeking, obtaining jobs and working 100% virtually. Of course, there were fraudulent candidates and companies. But where does the money come into play? Fraud happens only because there is something to gain, usually financially. Fraudulent candidates made money in two ways:

- Salary (at least temporarily)—Full-time employees and contractors were able to gain employment and earn a job for which they were not qualified. However, it was always a matter of time before people were exposed. Either way, the fraudulent employee made money.

- Double-dipping—Contractors would take on multiple full-time projects at once without disclosing the second project to either client. Another way of putting it is that people were (trying) to work 80-hour weeks in 40 hours.

Although people were affected, the fraudulent candidate phenomenon targeted corporations’ pockets. In the case of fraudulent companies, individuals are losing the money they need to survive. Here are some of the types of fraudulent companies and schemes I have heard about through my everyday calls and discussions with other recruiters:

The Fake Company: This ploy leverages the unofficial social contract between an employer and candidates that we have created in our society. This scheme targets new graduates, in particular. For instance, a new graduate gets a direct email from the representative of Real Bank (not a real company) about the perfect job for them (one that targets what their major was in college). The graduate goes through a very short interview process. And they get an amazing offer quickly: a competitive salary, flexible hours and exciting responsibilities. The catch? The company had no online footprint beyond the email address used for correspondence. Alarm bells only start to ring when the representative requests payment for a so-called “training kit” to start the job. The graduate eventually realizes they have been targeted by a scam. Not only is the “company” nonexistent, but the fraudsters also have the candidate’s personal information.

The “Upfront Fee” Trap: This scheme takes place when an offer goes out. Usually, the representative pretends to work for more of a household name or a well-known name within a given industry. Safe to say, we do not question JPMorgan or Google. Of course, they want to hire us! The offer letters seem standard, but there is one unusual clause: a requirement to pay a “processing fee” for onboarding materials. Job candidates believe that the fee is standard so they pay the fee, believing it to be a routine expense. Then, everything goes sideways. After the fee is paid, candidates do not receive further instructions or a start date. Then, they start questioning why they have not heard from the company and reach out multiple times, only to find that the email address and phone number were disconnected. They are then back to job searching.

The Too-Good-To-Be-True Data Collection Scam: This scam also involves what seems to be a legitimate company with a great website or a representative of a household-name company. Therefore, no one questions the interview process. However, this scam usually involves remote jobs, which provide the scammer a lot of cover. In this ploy, an offer is made that includes a flexible schedule and a high hourly rate, but the initial paperwork is unusual. Job seekers are instructed to download specific software for their “onboarding,” which includes a series of dubious tasks. The supposed onboarding tasks involve clicking on links that lead to websites requesting personal and financial information. Soon, job seekers start noticing unauthorized transactions in their bank accounts.

The Interview Scam: This is another scam that involves collecting information to leverage and exploit. A candidate receives a job offer from a high-profile company and is excited about getting a first-round virtual interview. The interviewer, however, conducts the meeting on an unsecured platform (not Zoom or Teams) and asks for access to the candidate’s personal social media accounts to “verify their qualifications.” The company also gets ahead of itself and asks candidates to provide sensitive information under the guise of a background check. Candidates usually get suspicious at this point and realize they are not speaking to a recruiter from Google at all. But it is too late. The information has already been shared.

The Payment-Upfront-Scheme: This scheme, which I probably heard about the most, usually targets lower-paying roles. It also has the qualities of scams we see in money laundering. A candidate in the administrative field, for instance, goes through an interview process with a company that seems legitimate. Of course, all the interviews are remote, but the job will be in the office in their local town or city. The candidate receives an amazing offer that they cannot refuse. In this case, the new employer sends money to the candidate. The money is for something job-related, such as “office supplies” to be purchased before their official start date. However, the candidate is instructed to deposit the check into their account and wire a portion of the funds to a third party. The check bounces, but the candidate is responsible for the funds they had wired out. The “employer” then vanishes, leaving the candidate both financially and professionally compromised.

Words of Wisdom

The pandemic and the transition to working from home created a breeding ground for fraud in the job market. Fraudsters had success being both fake job seekers and fake representatives of companies. Although the fraudulence phenomenon is not as prevalent as it was from 2020 through 2022, we must be vigilant to avoid falling victim for these schemes. Scammers, pretending to be representatives of fake (and, sometimes, real) companies, have become increasingly sophisticated. They have made it essential for job hunters to be proactive in protecting themselves. Here are some key strategies to help you identify and avoid fraudulent job offers:

Research the Employer. It is a terrible sign that I must advise people to research a company to see if they are even real. Up until recently, I advised candidates to research companies so they could go into interviews prepared and ready to impress. Unless I am the one presenting the role to someone, I tell candidates to do their best to verify the legitimacy of a company (especially if it is a company you have never heard of before).

- Verify company information: Check the company’s website, look for their physical address and confirm their contact details. Ensure that the website has a professional appearance and is free of errors or inconsistencies.

- Look for reviews: Read reviews on platforms like Glassdoor, Indeed or Google Reviews. It is not about negative or positive reviews at this point. The more reviews, the better. However, run for the hills if people are questioning the validity of a company. It is not worth the risk.

- Check business registrations: Verify that the company is registered with relevant business directories and governmental agencies. In the U.S., you can check state business registries to confirm legitimacy.

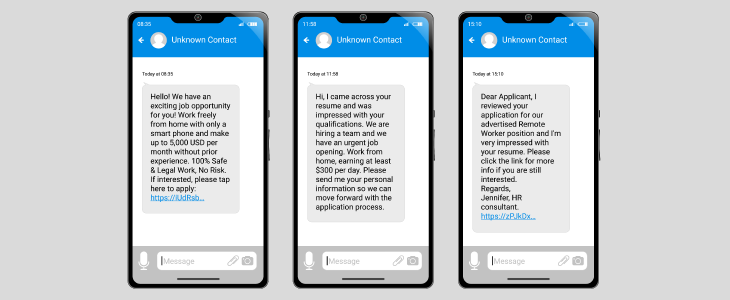

Watch Out for Red Flags in Job Listings. Be wary of job listings that exhibit the following signs:

- Too good to be true: Offers that promise unusually high salaries for minimal work or perks that seem excessive should raise concern.

- Vague job descriptions: If the job description lacks detail about the role and responsibilities, it may be a scam.

- Unprofessional communication: Poor grammar, spelling errors or unprofessional language in job postings or communication could indicate a scam.

Be Cautious With Personal Information. Protect your personal information throughout the application process:

- Avoid sharing sensitive data: Be cautious if asked for sensitive information, such as your Social Security number, bank account details or copies of personal documents early in the process. This information is important during onboarding, but no employer should ever ask for this information before you receive an offer.

- Secure communication channels: Ensure that communication with the employer occurs through secure and professional channels, such as official company email addresses. For instance, do not communicate with “representatives” of companies if they are using a Gmail address or an address that is obviously not associated with the company in question.

Examine the Interview Process. A legitimate employer will have a professional interview process:

- Check interview formats: Be cautious if asked to conduct interviews via informal platforms like social media or if the interview process is unusually informal.

- Assess the questions: During the interview, watch for questions that focus more on your personal financial details or require payment for background checks.

Verify Job Offers and Contracts. When you receive a job offer, take the following steps:

- Get the offer in writing: Ensure that you receive a formal job offer letter or contract outlining the job title, salary, benefits and other terms.

- Review contract terms: Carefully review the terms of any contract before signing. Be wary of contracts that require you to make upfront payments or commit to unusual financial arrangements.

Research and Ask for References. Verify the legitimacy of a job offer by:

- Contacting company representatives: Reach out to the company directly using contact information from their official website to confirm the offer and the individual who contacted you.

- Requesting references: Ask for references from current or former employees to gain insight into the company’s practices and culture.

Trust Your Instincts. Your intuition can be a powerful tool in identifying scams:

- Listen to your gut: If something feels off or you are uncomfortable with the way the employer is handling the process, trust your instincts and proceed with caution.

- Seek advice: Discuss any concerns with trusted friends, family members, recruiters or career advisors who can offer objective perspectives and advice.

Lastly, do not spend money. Have you ever watched the television show Catfish? It is always a catfish if someone—whom you have never met—asks for money. If a company or representative asks you to pay up front for something they owe you to do your job—a laptop, work materials, etc.—stop communicating with them and consider your job search back on. In a competitive job market, the allure of a seemingly perfect job can sometimes cloud judgment and lead to risky situations. By following these preventive measures and staying informed, you can significantly reduce your risk of falling victim to employment scams. Always remember that a legitimate employer will respect your due diligence and provide clear, professional communication throughout the hiring process.

Sanjeev Menon, ACAMS Career Guidance columnist, Legal and Compliance Practice managing director, Madison Davis, New York, NY, USA, smenon@madisondavis.com, ![]()

- Sanjeev Menon, “The Fraudulent Candidate Phenomenon,” ACAMS Today, December 2022-February 2023, December 12, 2022, https://www.acamstoday.org/the-fraudulent-candidate-phenomenon/

- Ibid.