The financial services sector, especially in the financial technology (fintech) area, has experienced a wave of layoffs lately. This article will cover six career options that are red hot right now in terms of hiring activity.

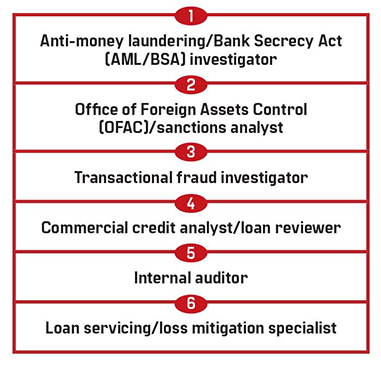

If you are in the job market and are relatively analytical in nature, you will likely qualify for an entry-level role in any of these six hot areas:

The following list is meant to provide descriptions of the careers, what skill sets each career requires and how each interacts with AML/BSA staff.

1. An AML/BSA investigator helps a financial institution (FI) or fintech identify those engaged in money laundering and terrorist financing and other bad actors. Smaller institutions without a fraud department may also identify fraudulent transactions. They do this by reviewing financial transactions in customer accounts. More seasoned AML/BSA investigators will likely document the case investigation and even write a suspicious activity report (SAR). Every FI needs these professionals. This is a great career for people who like big data sets, are naturally curious, like to solve puzzles and like to write using data and facts to “tell a story.”

How this position interacts with AML/BSA staff: These professionals are the AML/BSA staff!

2. An OFAC/sanctions analyst reviews the parties (individuals, businesses, vessels, aircraft, etc.) related to transactions flowing through U.S. banks, for the most part. They help FIs or other businesses ensure that they are not allowing transactions with sanctioned individuals or entities to flow through the bank or business. Every FI needs these professionals. This is a great career for people who like geography to the point where they can identify most countries on a map blindfolded, follow geopolitical events and are generally knowledgeable about international events. They are also naturally curious and can sense bad actors and evasive activity like it is a sixth sense.

How these professionals interact with AML/BSA staff: These professionals interact with AML/BSA staff when they identify bad actor activity that might also require a suspicious activity report (SAR), such as an activity that is potentially circumventing sanctions laws.

3. A transactional fraud investigator is similar to an AML/BSA investigator, except transactional fraud investigators may be working with real-time transactions in an attempt to not only identify fraud but to potentially thwart it as it is taking place. They have an uncanny ability to identify patterns in transactions that others do not see. In many institutions, transactional fraud investigators work closely with identity management professionals, ferreting out synthetic ID fraud, online account opening fraud and account takeover fraud. An example of this is when a fraud investigator notices that all of the previous night’s fraudulent online account opening attempts used the same three challenge questions and answers. Whereas AML/BSA investigators have weeks to analyze transactions and make their case of suspicious versus nonsuspicious, fraud investigators sometimes have as little as a few minutes.

How these professionals interact with AML/BSA staff: Many times, fraudulent activity has to be reported on a SAR. In some institutions, the fraud professional may draft the SAR, and in other institutions, the AML/BSA department handles SAR-related writing for fraud cases.

4. A commercial credit analyst/loan reviewer career may initially seem like a very different career from the careers described above, but there is a lot of overlap in terms of skill set. Commercial credit analysts/loan reviewers analyze the information in a business’s financial statements, the information on a loan application, payment history, appraisal information and other underwriting information to analyze a loan application and to “tell a story” about the applicant’s or borrower’s creditworthiness. Credit analysts may assign the applicant’s initial credit risk rating (or opine on it), while loan reviewers may opine on the risk rating of the ongoing relationship every year or so. These professionals are extremely analytical with large data sets and understand business. Commercial and industrial analysts and loan reviewers are especially knowledgeable about business operations, while commercial real estate analysts are especially knowledgeable about real estate as well.

How these professionals interact with AML/BSA staff: The interaction happens in three different ways.

a) When AML/BSA staff are writing a SAR or performing enhanced due diligence on a loan customer, their best bet is to obtain information on that customer from the credit analysts and loan reviewers.

b) When credit analysts notice fraudulent documents or statements during the credit review process, they will report such suspicious activity to the AML/BSA staff.

c) When loan reviewers notice suspicious activity after the loan is originated, they, too, will report such suspicious activity to the AML/BSA staff. Occasionally, loan reviewers may find that the borrower used the funds from the loan for a purpose other than the stated purpose of the loan. That could be considered suspicious.

5. Internal auditors in an FI are likely knowledgeable about all the areas above. Internal auditors plan and execute audit steps to test controls surrounding a law, regulation, function, department, product or service in an institution and ultimately issue a report on the results of the audit. Internal auditors typically get exposure to every part of the FI over time, and this serves as a great training opportunity for future roles in the institution. Internal auditors should be analytical, detail-oriented, good at documenting, naturally curious and professionally skeptical, meaning “trust, but verify.” Internal auditors verify controls by reperforming processes and testing transactions. Internal auditors should enjoy interacting with others at the institution and should have good writing skills.

How these professionals interact with AML/BSA staff: The interaction happens in three different ways.

a) Internal auditors are frequently involved in internal investigations, and to the extent that an internal investigation is also SAR-reportable, the AML/BSA staff will likely be involved. Internal auditors may also work with the AML/BSA staff on the investigation itself.

b) Internal auditors, especially the chief audit executive, serve as a sounding board for AML/BSA staff in that they are privy to SARs and can be involved in discussions about SARs.

c) Internal auditors also audit the AML/BSA program. This is usually a fairly involved process that has internal auditors and AML/BSA staff communicating with each other for several weeks.

6. Loan servicing/loss mitigation professionals are busiest when there are economic challenges taking place that force borrowers to seek payment options to avoid foreclosure. Loan servicing/loss mitigation professionals help borrowers restructure their loans or, at times, even exit their loans. Loan servicing/loss mitigation professionals must have empathy because they could be working with borrowers who might not be their best selves at the moment. Loan servicing/loss mitigation professionals must be extremely detail-oriented because this is one of the most regulated areas in the consumer compliance world. One missed check box can significantly impact an institution’s ability to mitigate loss.

How these professionals interact with AML/BSA staff: Similar to the credit analyst and loan reviewer roles discussed above, the professionals in loan servicing/loss mitigation can come across suspicious behavior and will report it to AML/BSA staff. Suspicious behavior could include providing fraudulent documentation to the FI or even paying loans with cash on a consistent basis.

For professionals in the banking industry who are analytical in nature, one of the six careers described above may be the perfect career, and all six careers are red hot right now, with active hiring taking place across the industry.

Sharon A. Blanchette, CAMS, managing director, eDelta Consulting, Inc., NY, USA, sblanchette@edeltaconsulting.com